12 Ways You Can Broker Without Investing Too Much Of Your Time

News content

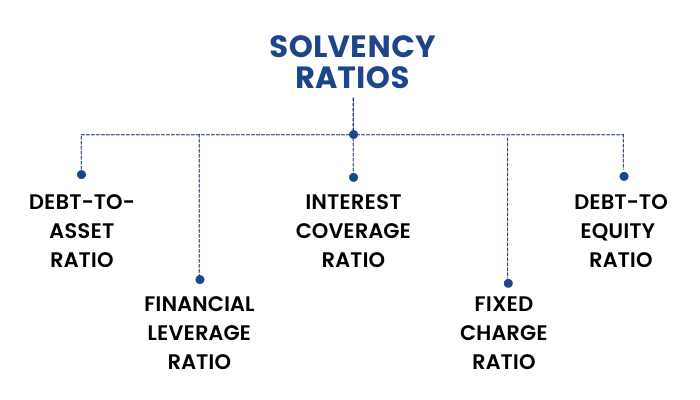

By taking out debt and using personal income to cover interest charges, households may also use leverage. In her 2011 article entitled “Framework for teaching practice: A brief history of an idea,” Pam Grossman explains that a teaching of practice program aimed at preparing teachers should include. Spanish English dictionary,translator, and learning. Spread bet on over 12,000 instruments. Forex trading does offer high leverage in the sense that for an initial margin requirement, a trader can build up—and control—a huge amount of money. Higher measures of leverage mean that a company’s operating income is more sensitive to sales changes. A relatively small market movement will have a disproportionately larger impact on the funds you have deposited or will have to deposit; this may work against you as well as for you. 44 203 355 5042105 107 Farringdon Road, London, EC1R 3BU. In the UK and the EU, the Financial Conduct Authority FCA and the European Securities and Market Authority ESMA and have both placed regulations restricting the amount of leverage available for retail traders to between 1:30 and 1:2 depending on asset class. 2016; Siqueira et al. The return on equity measures the profitability of a business in relation to its equity. By subscribing, you agree to our Privacy Policy and may receive occasional deal communications; you can unsubscribe anytime. This ratio is also expressed in another way, however.

What Is a Good Leverage Ratio?

The most important thing to understand when talking about leverage is the risk involved. Here’s how to calculate the financial leverage ratios. In contrast, higher leverage relative to comparable peers could be concerning, especially if the ratio has been trending upward in recent periods, as the two potential drivers are. 53 billion in liabilities. What have you learned from them, over the years. There are moments for fans where it will be nice to see that she still has this amazing support. Greenbeach Hospital Cop1 episode, 2021. XTB Group includes but is not limited to following entities:XTB S. If a fee is to be charged you will be advised of the fee prior to the personal information being provided. Using a leverage ratio of 20:1, you could potentially open a position worth $200,000 20 X 10,000 = 200,000. Companies with high operating leverage tend to have higher fixed costs than variable costs. It’s not just all for Parker, though. Published: May 10, 2023. Multilateral Development Banks MDBs and Development Finance Institutions DFIs and philanthropic investors at market rates. CFD and Forex Trading are leveraged products and your capital is at risk. Our Goods and Services Tax course includes tutorial videos, guides and expert assistance to help you in mastering Goods and Services Tax. Advisory services are offered through CrowdStreet Advisors, LLC “CrowdStreet Advisors”, a wholly owned subsidiary of CrowdStreet and a federally registered investment adviser. Leverage also works for investors in bolstering their buying power within the market — which we’ll get to later. The after tax cash benefit you will receive through rent is $100. This is more of a snapshot of the current situation, while the DOL above is more in tune with relative changes over time. Leverage ratios are one of several different financial measurements of a company. Under such an agreement, the asset becomes collateral for the loan and the lender receives interest on the amount advanced for the loan’s duration. Stay tuned to this page for updates on the release date, trailer, cast, news, and everything else you need to know about the show’s revival. Financial leverage is usually defined as. The first season sits at 93 percent on Rotten Tomatoes, with the consensus praising the revival’s fun streak but also that it allows the ensemble room to grow and evolve. If you live in a remote area and would like confirmation that we can install at your location in advance, https://trade12reviewblog.com/spread-in-stock-trading/ please email and we will be happy to discuss the installations we can offer, and whether any surcharges would apply. Learn financial statement modeling, DCF, MandA, LBO, Comps and Excel shortcuts.

Leverage Example

Our signature product is our quick reference laminated guides—the original laminated guides for educators. Ghost Pepper Guard1 episode, 2022. In recent years the average leveraged buyout has imposed debt almost seven times the target company’s EBITDA the company’s earnings before certain expenses. Source: Federal Reserve Board, Reporting, Recordkeeping, and Disclosure Requirements Associated with Regulation VV Proprietary Trading and Certain Interests in and Relationships with Covered Funds, 12 C. The currency market is open 24/7, 5 days a week which makes it very accessible to trade both day and night. In the case of FL, the higher the amount of debt, the higher the FL. The Leverage: Redemption team are all expected to return for season 3. “You would then pay the broker back $5,000 leaving you with $8,000. 332 but these firms also choose to be formally certified. Practise trading with virtual funds. Visit our Privacy Policy for more info, or contact us at or 80 Spadina Ave. The practices, and the four aspects of teaching and collaboration that organize them, are complementary, and teachers often use several at once. The greater the debt, the greater the leverage. Banking regulations for leverage ratios are complicated. The Basel III leverage ratio means that the capital measure is divided by the exposure measure. For instance, at the firm level, the Force for Good Fund associated with the online crowdfunding platform WeFunder invests in “Best for the World” CBCs that score in the top 10% of CBCs worldwide Force for Good Fund, 2019. Technical Support UnitKöthener Straße 2 3D 10963 BerlinGermany.

Popular TV on Streaming

LinkedIn and 3rd parties use essential and non essential cookies to provide, secure, analyze and improve our Services, and to show you relevant ads including professional and job ads on and off LinkedIn. These cookies help us to improve our website by collecting and reporting information on how you use it. So long as payments are made on time, expansion can continue, and additional borrowing remains an option. Josiah is a tech evangelist passionate about helping the world understand Blockchain, Crypto, NFT, DeFi, Tokenization, Fintech, and Web3 concepts. She buys 200 shares of XYZ with the $10,000 in her account plus $10,000 in margin funds borrowed from the broker. The Wall Street Prep Quicklesson Series. The standard trap traders fall into is when a position starts going in the wrong direction and the losses pile up. Do those two plus Breanna get more air time while less of Sophie and maybe Parker as the season went on. You can efile income tax return on your income from salary, house property, capital gains, business and profession and income from other sources. Using leverage can result in much higher downside risk, sometimes resulting in losses greater than your initial capital investment. For example, a person investing in real estate might be able to buy multiple properties and increase their returns by using several loans, rather than all cash. Your stop loss is worth 30 pips and with a 0. Mezzanine Funding SolutionsConsulting ServicesAcquisition FinancingOthers. He hasn’t been around, so he doesn’t really know how valuable she’s become. Theater box office or somewhere else. All that matters is whether or not you can cover your costs each month. Teachers introduce students to routines and provide opportunities to practice, analyze, and modify the routines. For example, the ancient Egyptians used levers to lift stones weighing up to 100 tons in order to build the pyramids and obelisks. If all goes well, you’ll repay your borrowed funds quickly and snag investment returns in the process. Ability to generate cash. For example, Apple AAPL issued $4.

Product Features

It would be surprising if companies didn’t have this kind of information on cost structure, but companies are not required to disclose such information in published accounts. The fan favorite group of modern day Robin Hoods are back on the job with Leverage: Redemption season 2, which sees the Leverage team reunite to once again steal from the wealthy and powerful for the benefit of the little guys. The degree of Financial Leverage Formula is used when Data from more than one Financial Year of a company is given. Get a free handheld massage gun when you purchase a massage chair. Debt to Capitalization Ratio = Short term Debt + Long term Debt/Short term Debt + Long term Debt+ Shareholder Equity. This is a ratio that’s commonly used by credit agencies, or banking agencies. Join this journey to elevate your understanding of leverage ratios significantly. Okay now let’s take a look at a quick example so you can see exactly how to use this ratio to evaluate a firm’s solvency.

Americas

If you decide you must trade these markets, you must practice good money management. It is calculated by dividing a company’s EBIT which refers to Earnings before Interest and Taxes by interest payments that are due in the current accounting period. You are now at the mercy of the repairman. Because Walmart sells a huge volume of items and pays upfront for each unit it sells, its cost of goods sold increases as sales increase. Then, the paper will illustrate the importance of cost structure under various scenarios. That being said, this figure varies from industry to industry. Using leverage can free up capital that can be committed to other investments. Interns begin working on eliciting student thinking starting in the first week of the program. The output of the degree of operating leverage formula can be read as “for each 1% change in sales, operating income will change by X %”. Teachers coordinate and adjust instruction during a lesson to maintain coherence, be responsive to students’ needs, and use time well. To open a conventional trade with a stockbroker, you’d be required to pay 1000 x 100 cents for an exposure of $1000 not including any commission or other charges. The consumer leverage ratio is used to quantify the amount of debt the average American consumer has relative to their disposable income. For example; If you want to open a position with £25,000 with a leverage of 25:1, then the margin would be; £25,000/25, which is £1,000. The equity ratio is a measure of the leverage a company uses. That may be a rental property that you maintain and lease out to tenants, which can create a steady flow of passive income each month. There are also operational leverage ratios, which are separate from finance leverage ratios. Molly Connell 1 Episode. Mary is not using financial leverage. Leverage varies by industry. Using the same example above, Bob and Jim realize they can only sell the house for $400,000 after a year.

Caroline Avery Granger

Find out more about what options trading is. Description: In other words, it is the difference between the investment return and the bench mark return for e. If you’re an entrepreneur or business investor, that might involve putting money into growing businesses. Though this isn’t inherently bad, it means the company might have greater risk due to inflexible debt obligations. In accounting, an asset is any resource that a business owns or controls. Before borrowing, therefore, a thorough analysis must be made of whether an investment will be profitable. The same is true for improving behavior. You can use many financial ratios to calculate your business’s financial leverage. The introduction of CRR II will also see the capital add on for G SIBs being implemented in the EU from 2023, in line with the Basel Committee’s requirements. From the equity multiplier calculation, Macy’s assets are financed with $15.

Follow HBR

These characteristics facilitate leverage and allow the prime broker to grant special funding conditions to hedge funds. Example: If an investor needs ₹100,000 in collateral to purchase ₹10,00,000 worth of securities, they can get a 1:10 margin. CFD Accounts provided by IG International Limited. Already have an account. The combination of fractional reserve banking and Federal Deposit Insurance Corporation FDIC protection has produced a banking environment with limited lending risks. A leverage ratio is one of many financial measures that assess a company’s ability to meet its financial obligations. All in One Universal Bundle 3700+ Courses @ 🎁 90% OFF Ends in ENROLL NOW. The Leveraged Buy Out LBO mechanism is particularly popular with investment funds and is generally regarded as the preferred financial arrangement for a company takeover. Join thousands of traders and trade CFDs on forex, shares, indices, commodities, and cryptocurrencies. The trader will open a maximum position and earn a profit of 5% on the first trade and lose 5% on the second trade.

Education /

You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money. Description: The unique feature of redeeming the contract before maturity or on the date of maturity gives it an added advantage of tradability. Investment advisors will take into account your cash flow, equity and assets using multiple ratios, as they all have their limitations. Transform classrooms and student performance with evidence based, effective practices. For the leverage exposure measure LEM, the PRA proposes a number of amendments to ensure the LEM falls in line with international developments. He is an avid reader and film buff who also publishes novels on the side. We offer margin rates on forex from 3. Most Popular TV on RT. It is important for all traders to bear in mind the risks involved in leveraged trading. In their science method class, interns reflect on two science lessons taught in the field, using reflective questions oriented to a the instructional framework introduced for structuring science lessons, b the Instructional Planning Considerations, and c the equity practices emphasized in the class. The performance of leveraged ETFs may differ significantly from the performance of the underlying benchmark index. That said, let’s take a quick look at the following example. The goal of financial leverage is to increase an investor’s profitability without using additional personal capital. Most of the original Leverage cast is returning for Leverage: Redemption. In this formula, the percentage change is calculated year over year. A leverage ratio is a financial measurement that determines how much a business relies on debt for day to day capital. Potential for Greater Losses: Leverage traders could have their position closed out at a loss, potentially a substantial loss.

Home hot new top

Access and download collection of free Templates to help power your productivity and performance. Businesses leverage their operations by using fixed cost inputs when revenues are expected to be variable. This increases risk and typically creates a lack of flexibility that hurts the bottom line. Leverage Ratio: What is it, and why is it important. Industry: Industries with stable cash flows and low operating costs, such as utilities, can typically undertake more leverage than industries with high operating costs, such as airlines. Accounting leverage is total assets divided by the total assets minus total liabilities. While leveraging borrowed funds can lead to increased returns and potential tax benefits, it can also come with the risk of default and interest payments. However, just as holding a magnifying glass too close to a flammable object can cause it to ignite, using too much debt can lead to the risk of default. That data will not only help teachers to identify the student’s strengths and needs, but also allow them to spot potential supports and barriers to the student’s learning throughout the school. A financial leverage example would be a company that borrows funds to buy a new factory with the expectation that it will produce more revenue than the interest on the loan. In 2006 and 2007, a number of leveraged buyout transactions were completed that for the first time surpassed the RJR Nabisco leveraged buyout in terms of nominal purchase price. By continuing you agree to the use of cookies. Air date: Nov 23, 2022. If you have been involved in a scam linked to Forex or suspect that your broker is acting in a shady manner, do not hesitate to contact our expert Forex Lawyers. In general, increased amounts of leverage in the capital structure equates to more financial risk, since the company incurs greater interest expense and mandatory debt amortization as well as principal repayments coming up in the future. The agreement is an excellent example of the level of creativity companies can exercise when securing funding. Throughout this work, they explore equity implications of different approaches. But get it wrong and a trader could end up facing a much larger loss than usual. Shelby is an entertainment enthusiast and pop culture writer. Lawyeruncredited1 episode, 2021. Profit Velocity Analysis. What are the characteristics o. We use vendors that may also process your information to help provide our services.