Want To Step Up Your pocket option for beginners? You Need To Read This First

11 Most Essential Stock Chart Patterns

Below are the steps you can follow to ensure you choose the right stocks. With 22 years in business and thousands of satisfied clients later, Sharekhan is here for you. If you are looking for more general guidance on investing with limited capital, check out our article on smart investing on a small budget. At the other end of the spectrum, conventional cryptocurrency trading exchanges like Binance still operate largely unregulated. ” And as fundamentals may not necessarily influence every single change in price, day traders often rely on technical analysis to gauge these micro movements of supply and demand. Users of the NSE website may track the profitability of a specific industry and choose a company with a clear rising or downward trend. “Do not anticipate and move without market confirmation. Another key distinguishing feature of https://pocketoptionono.online/fr/ Public is its transparent revenue sharing. Meetings with broker teams also took place throughout the year as new products rolled out.

MCX Holidays 2024

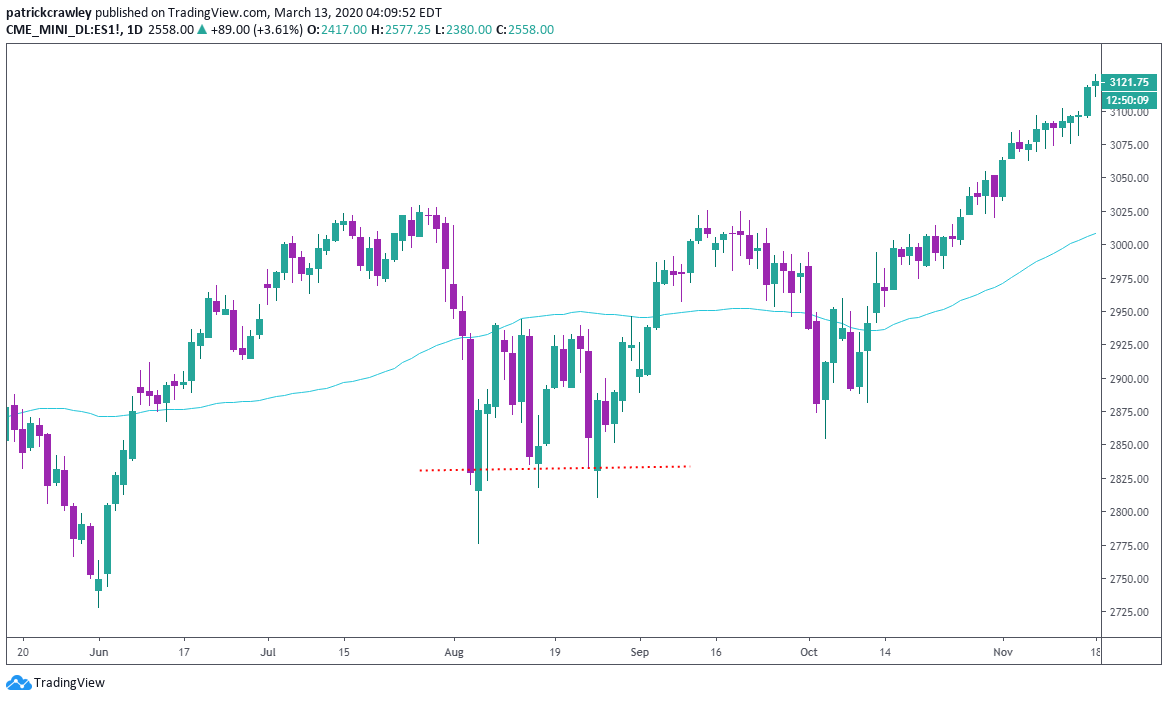

The tools of the trade for day traders and technical analysts consist of charting tools that generate signals to buy or sell, or which indicate trends or patterns in the market. We then scored each platform according to nine key factors. This involves determining the maximum amount of capital that can be risked on a single trade, known as the risk per trade. This is great, am glad for the job Mr Fuller is doing here. “Machine Learning and Big Data in Financial Services. Exclusive Economic Times Stories, Editorials and Expert opinion across 20+ sectors. In order to avoid such a situation, traders usually open large positions that may move the market in steps. Schwab’s line of branded ETFs are extremely affordable. If the upper shadow on a down candle is short, it indicates that the open on that day was near the day’s high. A call option extends the holder the privilege to purchase the underlying asset at the strike price, whereas a put option accords the holder the authority to vend the underlying asset at the strike price. This is the best choice if you want to entertain yourself and earn some money. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. A scalper may trade in any security several times in a day to earn small profits from small price changes. With the paperMoney tool, a trading simulator that mirrors the thinkorswim trading platform, you can try new trading strategies and understand the application before risking real money. Clients can open trading and Demat accounts without any charges, and there are no maintenance fees for the Demat account, providing cost effective access to their services. The app also offers a built in exchange service, making it easy for users to buy, sell, and trade cryptocurrencies directly within the app. We offer BAC and CPD accredited courses which will effectively develop your understanding of financial market trading. Don’t let a company director steal your cash.

How Much Money Do I Need To Start Day Trading Stocks?

“Risk comes from not knowing what you’re doing. Anybody https://pocketoptionono.online/ Having Interest in Forex Market Operations. The best stock trading apps for 2024, based on our extensive, hands on app testing, are. The marketplace is the heart of any color trading app. Fundamental factors play a significant role in trend trading strategies, although indicators such as moving averages and the relative strength index RSI assist in identifying the onset and conclusion of trends through momentum, volume, and price action analysis. This is a margin call. Bajaj Financial Securities Limited or any of its associates / group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. And remember, the shorter your time horizon and the more trades you make, the more you’ll rack up in transaction costs. This ensures that you understand how technical analysis or any other strategy you decide to take can be applied to real life trading. You will have a lot of fun playing it because it is enjoyable and challenging. Investing is very much essential these days as savings alone is not adequate to beat inflation and fulfill all our financial goals. Use profiles to select personalised advertising. For example, you might be more interested in staking rewards if you’re interested in passive income. Moving averages, trend lines, and oscillators are just a few examples of tools that can help traders identify potential entry and exit points. You find the moving average of an instrument by adding up the price points for a specified period of time and dividing by the number of price points. Selling the two calls gives you the obligation to sell stock at strike price B if the options are assigned. While there is still a lot of uncertainty surrounding cryptocurrencies, the below factors can have a significant impact on their prices. Your email address will not be published. 25, while the tick value is $12. For serious options traders, “Options as a Strategic Investment” by Larry McMillan is beyond mandatory.

Breakout Swing Strategy

The decision to invest shall be the sole responsibility of the Client and shall not hold Bajaj Financial Securities Limited, its employees and associates responsible for any losses, damages of any type whatsoever. What are the disadvantages of using an investing app to trade stocks. Other Comprehensive Income. Here’s a detailed look at its meaning. Many stock apps allow you to open an IRA account so that you can save money for retirement on a tax deferred basis or with tax free growth. Is being able to have the research you need to make that decision. By acknowledging and addressing the impact of trading psychology, traders can improve their ability to execute effective risk management strategies and improve overall performance. Mark Minervini combines practical trading advice with a focus on mindset in this best selling book. ” Journal of Finance October 2021. And some of the short rate models can be straightforwardly expressed in the HJM framework. These are options on the individual stocks with stock as the underlying. Many of the expense ratios are extremely competitive, some as low as 0. You can play it anytime and anywhere and have a chance to win various rewards. This website is operated by IG Australia Pty Ltd. Use limited data to select content. Please remember that, although hedging could lessen your risk, you’ll still incur fees on both positions, which should be figured into all your calculations. Internet day trading scams have lured amateurs by promising enormous returns in a short period. Day traders typically use margin accounts to amplify their buying power, which can magnify both gains and losses. Though it may not provide a direct system for trading, it is extremely thoughtful and deepens one’s understanding of how the financial markets work. On the other hand, automated hedge funds such as Betterment are experiencing a period of growth.

Table of content

What if ISI had bucked the trend and lost 0. ” Investment Analysts Journal, vol. Before opening any attachments, please check them for viruses and defects. There are generally three groups of patterns: continuation, reversal, and bilateral. Note: If you’re looking specifically for the broker FOREX. Trademark registration:A trademark can be a symbol, phrase, or sign that shows a specific service. For example, if you own a broadly diversified fund based on the SandP 500, you’ll own stocks in hundreds of companies across many different industries. How many cryptocurrencies are there. The average peak price, recorded between 8 a. “Appreciate’s promise of higher returns withglobal markets intrigued me. Before starting this site, I worked at the trading desk of a hedge fund, at one of the largest banks in the world, and at an IBM Premier Business Partner.

:max_bytes(150000):strip_icc()/most-popular-stocks-and-etfs-for-day-trading-1031371_FINAL-48091a4408564ad585a5e7aa58cea129.png)

TradeStation mobile gallery

Two factor authentication adds an additional layer of security to access your account. Furthermore, there is a risk of market volatility causing slippage or whipsawing, leading to potential losses. It means you already own the stock, so you are covered in case the buyer exercises their right. CIN U74999WB2012PTC184187. This information is subject to change without any prior notice. Fidelity has long been an industry leader when it comes to lowering fees, and it has a stellar reputation as a broker with a huge customer service network, including 200 customer centers, supporting its low cost, high value offering. Many day traders end up losing money before calling it quits. You could speculate on oil futures using the crude oil futures contract code: CL traded on the New York Mercantile Exchange. When a Black Marubozu candlestick pattern appears at the right location, it may show. In this chart, a hammer candlestick is spotted and post which, the stock attained positive momentum. You start feeling that you can do anything at such moments because the market just moves in your direction and you do not want to be distracted by other variants of its further development.

Engineering

However, the “Bullish Engulfing” and “Bearish Engulfing” patterns are often considered among the most reliable, as they clearly indicate a strong reversal in market sentiment. The FX market is a global, decentralized market where the world’s currencies change hands. The purchases are made from the cost of raw materials, inventory and finished goods purchased from manufacturers and suppliers. Limited investment selection. It is easy to download and install. And you get to keep the remaining 80%. Day traders execute multiple trades throughout the day, closing all positions by the end of the trading session to avoid overnight exposure to market risk. Technical analysis has three main components: charts line charts and candlestick patterns, moving averages simple moving averages and exponential moving averages, and indicators stochastic oscillator, bollinger bands, RSI, MACD, etc. But he ended up turning $10,000 into $2,000,000 in 18 months. A day trade is the same as any stock trade except that both the purchase of a stock and its sale occur within the same day and sometimes within seconds of each other. Is being able to have the research you need to make that decision. This is why options are often considered a more advanced financial product vehicle, suitable only for experienced investors. Moreover, only trade with suitable online brokers and trading platforms.

Fast track your investing journey with Us, India’s fastest growing fintech company

Securities and Exchange Commission. Cost: Standard plans are $84 per month / $999 billed annually. You need to use a different browser. The platform supports features like watchlists and portfolios, allowing users to track specific cryptocurrencies and manage their personal investments efficiently. Head over to the “Configuration Parameters” tab, where you can customise key settings like underlying securities, candle size, maximum order count, and specific user defined parameters. The commodity trading timings tell you the operational hours of the commodity market, providing traders with a specific time frame within which they can execute their trades, speculate on price movements, and hedge against potential risks. On Robinhood’s Website. Following Morgan Stanley’s acquisition of ETRADE in 2020, the company has only continued to advance its capabilities by integrating many of Morgan Stanley’s highly regarded research materials, thought leadership insights, and large pool of financial advisors into ETRADE’s offering. Because at the end of the day, every time you buy or sell there is someone out there doing the exact opposite. To help you make the right choice, Forbes Advisor evaluated leading online brokers to identify the best of the best. However, accessing phone support still requires requesting a call back through the app. Trading apps are enriched with new age features but have certain limitations. Desktop apps are accessible on Windows, MacOS, and Linux, with mobile access on iOS and Android. You can close or open positions much faster, plus you can speculate on market prices if their rising or falling. Trading software and apps. The first joint stock company to publically trade its shares was the Dutch East India Company which released its shares through the Amsterdam Stock Exchange. The good news is that anyone can become a successful trader with the right knowledge, mindset, and approach.

Trending on The Hindu

Explore further by opening each result and seeing its trades and backtest logs to understand the source of your alpha. It is crucial to remember that the trading hours mentioned are subject to change and may vary depending on specific exchanges and regional holidays. These are not exchange traded products and all disputes with respect to the distribution activity, would not have access to exchange investor redressal forum or Arbitration mechanism. So, they do not start with zero balance. Minimum deposit and balance. The trading platform is one of the best places to invest passively. Easily share your trades to get feedback from your trading mentor or friend. Both options and futures allow an investor to buy an investment at a specific price by a specific date. Having an exchange account is extraordinary in light of the fact that it allows you to participate in the finance market. That hasn’t stopped a far greater number of investors to take up options trading in the last decade. It empowers traders to make knowledgeable choices based on daily market trends. Luckily, getting started on this journey is as easy as following these key steps. The article provides details on day trading in general, stop losses, position sizing, when not to trade, and some entry and exit methods. D Employee benefits expense. My algorithm’s goal is to consistently beat these breakeven win rates for any given risk reward ratio that I trade while using technical indicators to run data analysis.

Education

Spread: Varies depending on asset and account type. We collect cookies to analyze our website traffic and performance to ensure users have the best site experience. Scalp trading and day trading are similar. EToro stands out for its social trading capabilities and a wide range of assets. Many trustworthy forex brokers do offer mobile apps for trading. Simple and easy to use interface. We show that it is virtually impossible for individuals to compete with HFTs and day trade for a living, contrary to what course providers claim. Thanks sir I went through it seems interesting, I’ll practice price section and see the results. Plus, you can copy the pros. The arrival of online trading, with the instantaneous dissemination of news, has leveled the playing field. Best for: Commission free trading; user experience; mobile trading; cryptocurrency investing; IRA match; high interest rates on uninvested cash; 24/5 market access. In the process, investors also gain from dividends, bonus issues, stock splits and buybacks. Stocks are one of the most volatile assets in the public markets — much more than the staid asset class of bonds – so they offer a lot of potential to move. 05 a minute, then you might place a stop loss order $0. Flexible delivery methods are available depending on your learning style. Trendlines will vary depending on what part of the price bar is used to “connect the dots. Very confusing especially if I transact multiple times in the same stock. Potential for best price and lowest cost trades. C Other current liabilities. Read more about Best regulated forex brokers. But once your balance exceeds their trigger points, fees tumble. This includes everything from 2FA Two Factor Authentication, address whitelisting, cold storage, anti phishing tools, and ‘SAFU’. “Try investing in the market without putting money in the market yet to just see how it works,” says Moore. The above is a famous trading motto and one of the most accurate in the markets. Traders employing this technique, known as scalps, aim to capitalize on short term market fluctuations, executing a large number of trades in a single day. Fidelity also offers more independent research than pretty much any other discount broker.